Alternative financing

Value Proposal

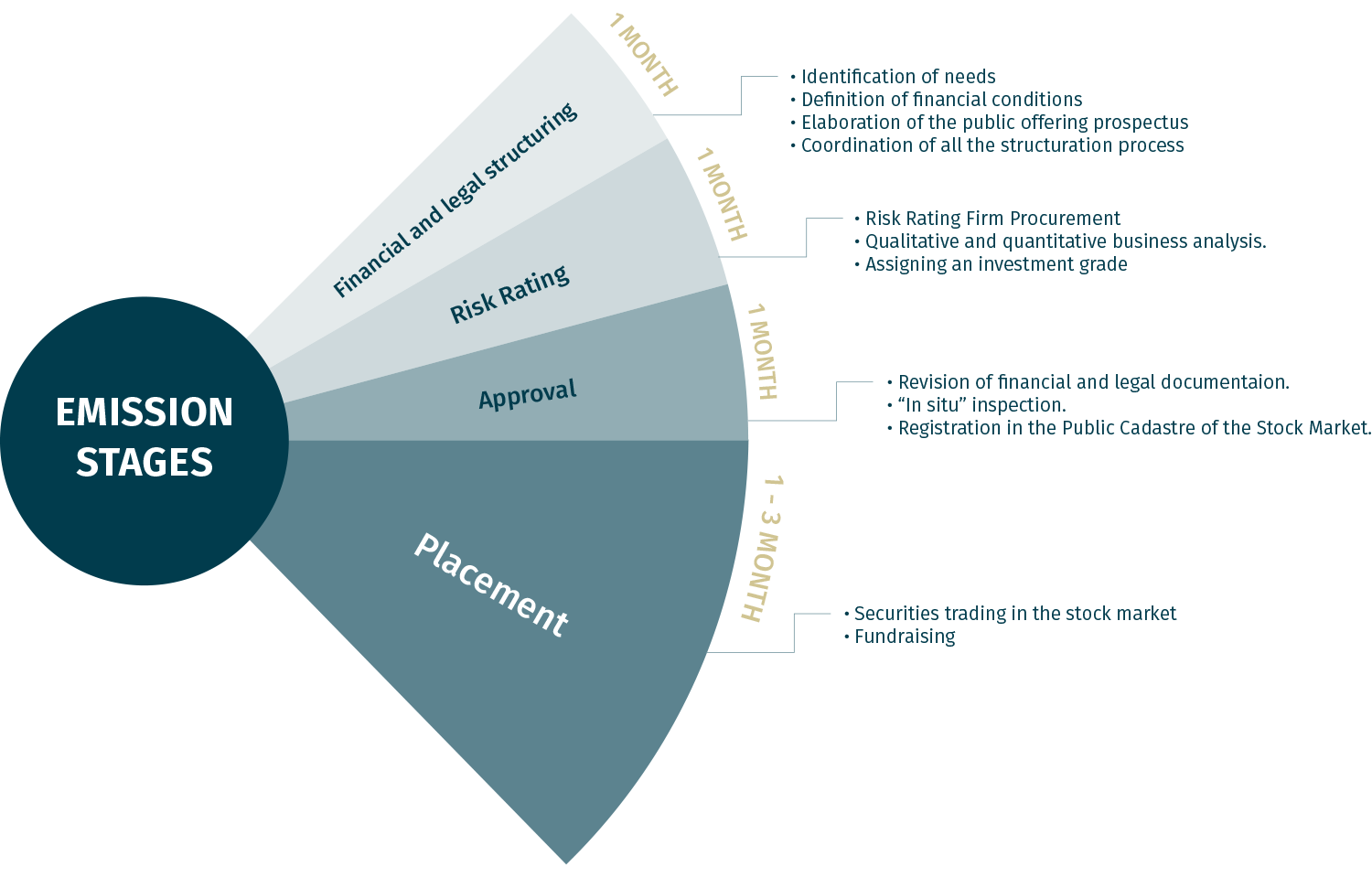

The Stock Market offers an excellent option to obtain alternative financing for your company projects. You will find custom products with rates, term and amortization structure that adjust to your needs and your company cash flow, besides of a wide segment of investors. MERCAPITAL goes beyond the legal and regulatory standard. For new customers in the stock market, we offer prior to the issuance monitoring that will allow to determine the viability of issuing securities in the stock market, along with counseling for your company to be ready with the desirable conditions to be successful in your future incursión in the stock market. Also, our public offering prospects offer exceptional quality because of its content of market and economical information, financial analysis, among others. You can see one of our prospects clicking this link. Beyond that, we also offer after issuance monitoring that will allow you to verify the financial situation of the company, counseling in correcting diversion of projections and budgets, reports to different control entities, among others.

Products Description

Financing can be obtain for your company through Assets, Liabilities and Equity:

1. Assets

Securization

It is a mechanism of financing that allows to transform your assets or goods, present or future, through an scrow, in tradable securities in the stock market to obtain liquidity in competitive conditions in the market, with the consequent reduction of financial cost.

Tradable commercial invoices

Allows companies to obtain funding turning their assets in liquidity through the invoices receivable of their customers. The issuer or supplier will be able to trade with a discount the invoices issued to their customers with their acceptance. Thus, the supplier obtains liquidity sacrificing an amount (discount) that will be applied according to the market conditions and the term of the invoice.

2. Liabilities

Long Term Corporate Bonds Issuance

This product adapts to your needs of long term funding, you can issue securities with maturity of more than 359 days and we will advise you to structure the amortization format according to your company business model cash flow generation.

Short Term Corporate Bonds Issuance

This product adapts to your needs of short term funding, with maturity of 359 days or less. Unlike long term bonds, short term bonds don’t have an interest rate, but each security is traded with a discount rate and all the security value is paid on maturity.

3. Equity

Shares

This product allows that through an initial public offering you obtain funding oppening your equity to investors that want to be partially owners of your business. The advantage of this product is that you don’t have the obligation to do regular payments to investors and you do them through dividends according to what the general meeting of shareholders determines.